7 MINUTE READ

Read this post to learn more about borderless™ and Paypal, and how these two payment platforms compare.

What exactly do borderless™ and PayPal do?

borderless™ is a global payments company making bank payments simple, accessible, and affordable. We have built a global yet local infrastructure connecting local payment rails around the world under one system. In the process, we created new ways for people and businesses to send funds overseas avoiding bank wire fees and providing better FX rates. We offer both pay-in (collections) and pay-out products both via webapp or API.

PayPal is a global online payments processor that facilitates online money transfers between businesses and individuals. PayPal is arguably the most recognized or well-known name in the e-commerce and online payments industry, and it is a common feature of online checkouts on shopping sites like Amazon and eBay.

Though both borderless™ and PayPal are payment processors and compete in the same niche in the payments ecosystem, an important distinction to highlight is that PayPal processes credit cards, while borderless™ does not and borderless is designed and built for marketplaces.

Who uses borderless™ and PayPal and why?

Many businesses around the world use payment platforms such as the ones offered by borderless™ and PayPal to collect payments on their websites or make payments to individuals or vendors. These businesses come from many industries, including:

- Online Marketplaces

- Travel & hospitality

- Shipping, logistics and fulfillment

- Software

- Education

- E-commerce

- User Testing

So now that you understand the basics of the services that borderless™ and Paypal offer, how do these two companies and products compare?

borderless™ vs. Paypal at a Glance>>

What are some common, useful features of both platforms?

1. Secure and easy payment process

Consumers only input their bank account credentials (or card information for PayPal) once when making their borderless™ or PayPal account. Then, when making online payments with borderless™ or PayPal, consumers only need to input their borderless™ or PayPal account ID and password. By getting rid of the hassle of manually inputting this information for every transaction, both borderless™ and PayPal expedite the checkout process for consumers and save businesses time when making payments.

Overall, this also means greater security, as merchants never have access to your private information. This allows for more protection against fraudulent transactions while engaging in e-commerce. And for B2B payments, businesses do not have to share their banking information with their clients, making the process more private and secure.

2. Account for both individuals and businesses

Both borderless™ and PayPal offer the ability to create business and personal accounts, unlike other payment processors like Stripe, which only allow business accounts.

This service allows individuals to be able to pay and get paid. Since e-commerce is a growing market and the gig-economy is booming, this is an important feature.

In addition, making a personal or business account with borderless™ and PayPal is easy– with borderless™, creating an account takes only two minutes!

3. Payments To Anyone Using An Email or @handle

Both borderless™ and PayPal offer payments using an email. What does this mean? If a business needs to pay a user, they can simple pay them by using non-sensitive information. This a widely used feature by online, freelancers, influencer, etc. type marketplaces to reduce their data liability.

borderless™ has built a “@handle” system that allows companies to pay anyone (vendors & individuals) using a publicly available information instead of an email. It also provides marketplaces a widget that enables users to enter their banking information in order to get paid without saving that information. In exchange they get a “@handle” to pay that user. It keeps all transactions secure and both personal and banking information private.

7 Key Differences between borderless™ and PayPal

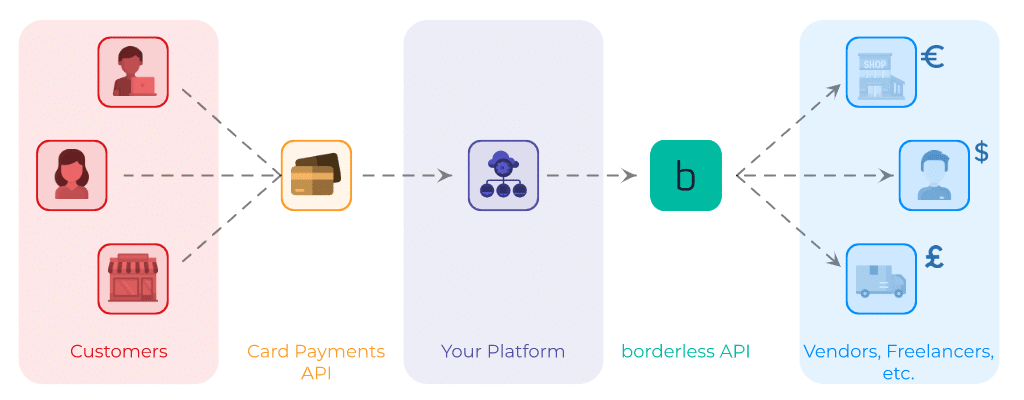

1. borderless™ Is Designed For Marketplaces With an API Focus

While you can create a business and personal account on both platforms, borderless™ specializes in payouts and created tools for businesses of all sizes such as a simple web application or a plug and play API. We built borderless with online marketplaces in mind such as freelancer, influencer, goods & services and gig economy which is why we have developed a “@handle” system and a plug & play API. See “@handle” system section to above to learn more. borderless is also able to connect to Stripe and other collection processors to conduct fast and easy payouts. Funds do not need to be transferred to your bank and then back to borderless.

In addition, borderless™ offers a suite of business focused features for business payments. These features include but not limited to, white label, accounting integrations, automated international transfers, subscription payments, recurring invoicing, mass payouts via CSV or API, contractor payments, and more.

On the other hand, PayPal focuses on e-commerce payments. You can still make payments as a business or to a business on Wise, however you will be missing out on a lot of features

2. International Coverage

PayPal services 73 countries whereas borderless™ covers over 100+ countries and plans to expand to an additional 40+ countries in 2022. Here is a full list of the current countries.

For online marketplaces, freelancer, influencer or travel marketplaces, 60 countries is limited. They don’t want to integrate multiple APIs as that might be costly.

2. Pricing and Fees

The biggest difference between Paypal and borderless™ relates to pricing and fees. PayPal is a much more expensive option than borderless™, both locally and internationally.

Local

Paypal does not charge consumers a fee for making local payments in-person or online. In other words, buying is free with Paypal. However, for merchants who are selling to consumers (C2B) or for business-to-business (B2B) payments, the fee for an online transaction is 2.9% plus a flat fee of $0.30, with no fee cap.

On the other hand, borderless™ charges only 1% plus a flat fee of $0.30, with capped fees of $50. Moreover, for B2B transactions, it is 0.1% with a capped fee of $15 USD.

One of the primary reasons why borderless™ is able to offer these low, affordable rates is because we do not process credit cards.

For example, for a $5,000 payment, the processing fee would be $145.30 using Paypal, whereas using borderless™, the fee would be $50. That is a 67% cost-savings, allowing you to keep nearly three times more of your hard-earned money.

International

For an online international transaction, PayPal charges 2% plus a flat fee that depends on the country in question (e.g. $0.30 USD and €0.35 EUR). In addition to this fee, PayPal charges 4% for currency conversion and 1.5% for receiving payments from another country. All these fees add up to 6%+ for merchants receiving international payments.

In contrast, borderless™ charges 2% + 30c and are capped at $30 USD or the equivalent in other currencies. And unlike PayPal, the currency conversion is included, with a better exchange rate close to the mid-market rate (the average of the price at which people are buying and selling the currency). borderless™ guarantees a better FX than PayPal. Check out our most up to date pricing here.

API Pricing For Payouts

For marketplaces and other businesses who utilize an API, borderless™ offers lower transaction fees. borderless™ charges a monthly subscription fee and charges flat fees per FX international payments as low as $1 per payment. Contact our sales team to see which API tier you qualify for.

3. Payment Methods

PayPal is characterized by having an account that can hold a balance of money. When you receive a payment via Paypal, the funds are deposited into your PayPal account. Though transferring funds over PayPal takes place immediately, transferring the funds from your PayPal account to your bank account usually takes 1 business day for local transactions, but it can take up to 5 days “depending on your bank’s clearing process.” Moreover, for international transactions, the transfer takes at least 3-5 business days.

borderless™, on the other hand, does not hold your funds by default. Instead, borderless delivers the funds directly to their bank account in their local currency using local payment rails (where possible) avoiding bank fees. It reduces the manual step of having users the need to “cashout” from their wallet to get paid and the funds get there within 1-4 business days. Local payments can happen even same day.

4. Multi-currency Balances

borderless™ offers the ability to hold, receive and exchange in 25+ foreign currencies. This avoids the need for your company to open foreign bank accounts or subsidiaries oversees allowing you to go global in seconds.

borderless™ does not charge fees for adding funds nor incoming wire fees when collecting to your multi-currency balances.

5. Customer Service

Though it may not be the first thing one thinks about when it comes to a product or service, customer service is a vital part of a payments company. Questions or issues are bound to arise in the course of conducting business.

PayPal is not known for incredible customer service. In fact, a simple Google search will tell you that customers are generally not satisfied with the help they receive from PayPal.

Customer service at borderless™ is different. We provide quick responses to questions that you might have as you navigate our website or use our product. We also provide dedicated account managers for marketplaces to handle all their payment needs for smooth payroll.

In addition to having the ability to talk on the phone to a customer service representative, there is a live chat option on our website (pictured above) that will connect you to a team member within 15 minutes so your question can be addressed.

When you use borderless™, you can rest assured that you will have a simple and secure user experience, and that there will always be a real person there to help you around the clock.

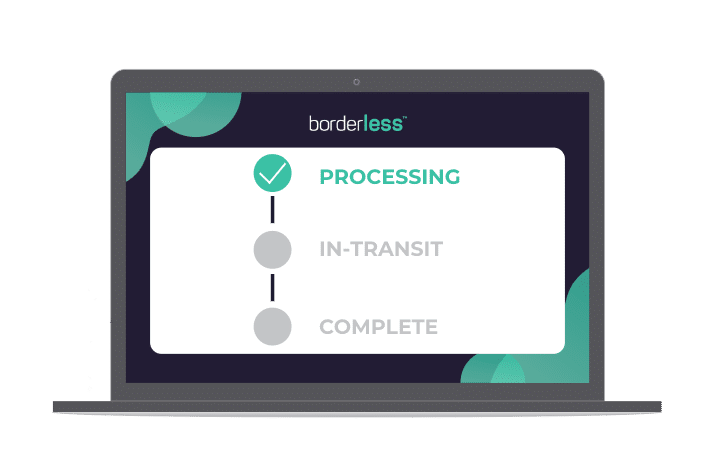

6. Payment Tracking & Request Reminders

Another key difference between borderless™ and PayPal is that borderless™ offers payment tracking and reminders, while PayPal does not. With borderless™, you can track your payment in real-time so you know where your funds are at all times. You can also send request reminders directly through the platform to avoid chasing people down.

These abilities provide borderless™ users many benefits:

- Improved control over your liquidity (cash flow) with estimated funds arrival time.

- Transparency over the whole payment process for peace of mind – No more guessing if they have paid or not.

- Reduced admin work so you can focus on what is truly important for your business.

- Reminders are sent from borderless™ and not the requestor removing the friction between you and the client for outstanding payments. This feature keeps a more efficient and professional relationship between you and the client with less back-and-forth interactions.

7. Fast Bank Checkouts

A final key difference between borderless™ and PayPal is that borderless™ enables your customers to pay with their bank without signing up for an account, while PayPal does not.

With borderless™, One-Time bank checkouts are now possible, which enables your customers to checkout more conveniently while saving you up to 90% on payment processing fees vs PayPal. This is just the latest way that the borderless™ team is committed to saving you money and keeping you and your money safe with the highest privacy and security standards.

Final Thoughts

PayPal and borderless™ are two payment processors that offer similar services to your company.

borderless™ is designed by dreamers, for dreamers. That’s why we care about what matters most to your company: your bottom line, ease of use and customer service. borderless™ is the more affordable payment processor by far, like x5 more! This is not to mention our superior customer service, international coverage with local payment rails and improved user experience with faster payments.

Ready to get ahead? Create your borderless™ account today and experience global bank payments for yourself (Use code: GETSTARTED21).

Get borderless.