As platforms grow, payouts almost always become the first system to break.

What starts as a simple “send money to users” workflow quickly turns into a distributed systems problem involving compliance, foreign exchange, banking rails, retries, reconciliation, and failure handling across dozens of countries.

This is where a bulk payouts API becomes essential, not as a convenience, but as core infrastructure.

This guide walks through how bulk payout APIs actually work under the hood, what problems they solve, and what technical teams should evaluate when choosing or building one.

What Is a Bulk Payouts API?

A bulk payouts API allows a platform to submit many payouts in a single request while abstracting away:

- Banking integrations per country

- Currency conversion and FX execution

- Recipient validation and compliance checks

- Delivery across different payout rails

- Status tracking, retries, and reconciliation

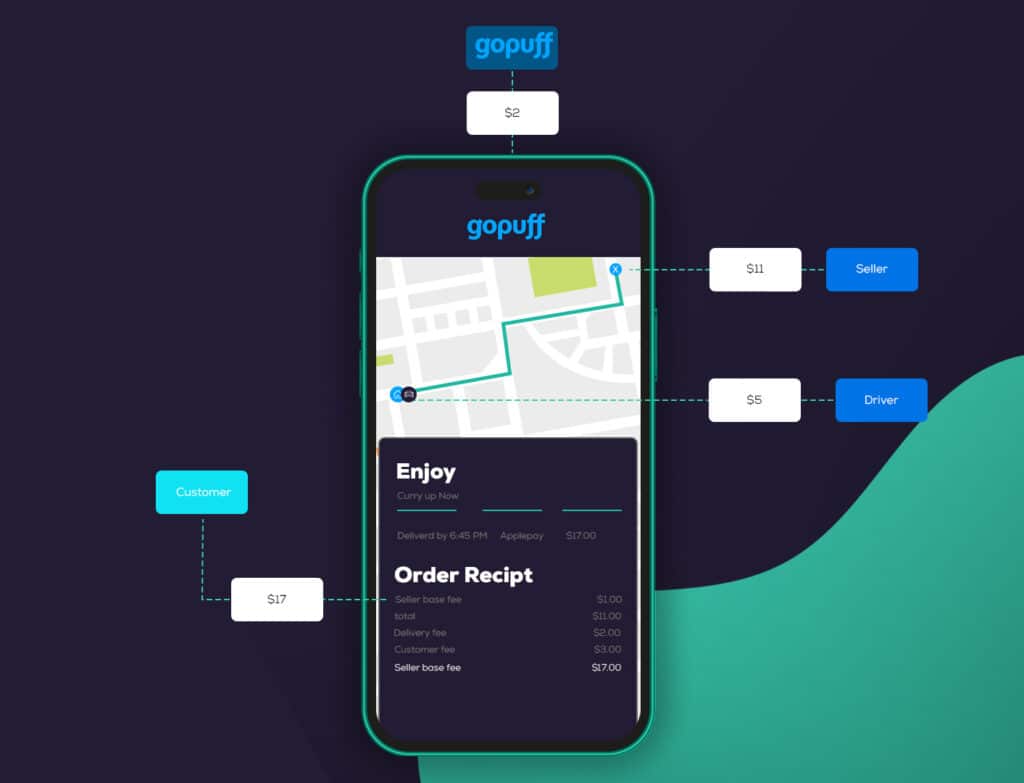

From the platform’s perspective, a bulk payout API behaves like a transaction orchestration layer sitting between your application and the global financial system.

Instead of integrating with dozens of banks, wallets, and card networks, you integrate once and let the API handle routing, execution, and edge cases.

How a Bulk Payouts API Works (Step by Step)

At scale, payouts are not a single action. They are a pipeline.

1. Recipient Creation & Identity Resolution

Before money moves, the system must know who is being paid.

A production-grade bulk payouts API will:

- Create or reference recipient records

- Normalize identity fields across countries

- Store payment method tokens (not raw data)

- Enforce country-specific requirements

At this stage, platforms often decouple:

- Identity (who the person is)

- Payout method (how they get paid)

This separation allows payout methods to change without recreating the user.

2. Real-Time Validation & Pre-Checks

This is where most payout failures are prevented.

Good bulk payout APIs perform pre-flight validation, including:

- Bank account format checks (IBAN, CLABE, BSB, etc.)

- Card eligibility for push payments

- Wallet availability by country

- Sanctions and compliance screening

- Minimum and maximum amount checks per rail

This happens before funds are reserved, not after which dramatically reduces downstream reversals and support tickets.

3. Funding & FX Execution

Bulk payouts are typically funded in one of three ways:

- Prefunded balance

- Just-in-time funding

- Net settlement

Once funded, the API must decide:

- Whether to pay out in local currency or source currency

- When to execute FX (upfront vs just-in-time)

- Which FX rate model applies (fixed, real-time, blended)

At scale, FX becomes a margin lever. APIs that batch FX execution across payouts can significantly reduce cost compared to per-transaction conversion.

4. Payout Routing & Rail Selection

This is the heart of the system.

For each payout, the API determines:

- Which rail is available in the destination country

- Which rail meets the SLA (instant vs next-day)

- Which rail minimizes cost and failure risk

For example:

- Local bank transfer vs cross-border wire

- Card push vs wallet credit

- Instant rails vs standard clearing

Advanced systems dynamically route payouts based on:

- Amount

- Destination

- Time of day

- Historical success rates

5. Execution, Batching & Idempotency

Bulk payouts are rarely executed as one atomic transaction.

Instead, systems:

- Break large batches into smaller execution groups

- Assign idempotency keys to prevent duplicates

- Track each payout independently

- Allow partial success within a batch

This design ensures that:

- One failed payout doesn’t block thousands

- Retries can be safely performed

- Systems remain resilient under load

6. Status Tracking, Webhooks & Reconciliation

Once payouts are sent, observability becomes critical.

A proper bulk payouts API provides:

- Per-payout lifecycle states (queued, processing, completed, failed)

- Webhooks for state changes

- Reason codes for failures

- Reconciliation-friendly identifiers

This allows platforms to:

- Update user balances accurately

- Trigger retries automatically

- Reconcile payouts against ledger entries

- Support audits and reporting

Bulk Payout API vs Traditional Banking

Traditional banking systems were not designed for platform-scale disbursements.

Key differences:

- Batch limits vs elastic scaling

- Manual file uploads vs API-driven automation

- Opaque failures vs structured error codes

- Fixed rails vs dynamic routing

- Per-country setups vs global abstraction

For platforms paying thousands of users across borders, the operational overhead of bank-native solutions quickly outweighs their perceived simplicity.

Common Bulk Payout API Use Cases

Bulk payout APIs are used by platforms that need predictable, repeatable payout workflows, including:

- Creator and influencer marketplaces

- Gig economy and labor platforms

- B2B marketplaces and vendors

- Affiliate and referral programs

- Gifting and rewards platforms

In all cases, the underlying problem is the same: pay many recipients reliably, at low cost, across many countries.

Technical Features That Matter at Scale

When evaluating a bulk payouts API, technical teams should look beyond surface-level claims.

What actually matters in production:

- Idempotent endpoints

- High API rate limits

- Deterministic retry behavior

- Strong webhook guarantees

- Sandbox parity with production

- Clear failure semantics

- Compliance tooling built into the flow

These are the features that prevent 3 a.m. incidents.

Why Platforms Use borderless API for Bulk Payout APIs

borderless is built specifically for platforms that need to operate globally from day one.

With borderless payments, platforms get:

- One API for bank, card, and wallet payouts

- Bulk and individual payout endpoints

- Real-time validation and routing

- FX optimization across markets

- Built-in compliance workflows

- Link Widget for recipient onboarding

This allows teams to focus on product, not payout plumbing.

Bulk Payouts API FAQs

What is a bulk payouts API?

A bulk payouts API lets platforms send many payouts in a single workflow while handling validation, routing, FX, and delivery automatically.

Can I send international payouts with one API call?

Yes. Batch payout APIs allow platforms to submit batches of recipients across multiple countries and payout methods in one request.

How do bulk payout APIs reduce failures?

They validate payout details upfront, route payments intelligently, and provide structured retries and error handling.

Are bulk payouts instant?

Some payout methods support instant delivery. Timing depends on destination country, payout rail, and method selected.

Final Thoughts

Bulk payouts are not a feature, they are infrastructure.

As platforms scale, payout reliability, cost, and observability become competitive advantages. A well-designed bulk payouts API turns what was once an operational bottleneck into a predictable, automated system.

For platforms operating globally, that shift is no longer optional.

About borderless

borderless powers instant global payouts for marketplaces, creator platforms, gig networks, and digital platforms. With coverage in 190+ countries, real-time FX, compliance automation, and support for bank, card, and wallet payouts, borderless is the simplest way to scale global payouts from hundreds to hundreds of thousands.

Learn more at: https://getborderless.com

# GlobalPayouts InternationalPayouts PayoutsAPI MarketplacePayouts CreatorPayouts CrossBorderPayments FXRates WholesaleFX FBOAccounts FintechInfrastructure PaymentsVsPayouts MassPayouts PlatformEconomy borderless getborderless