Over the past few years, freelancer marketplaces and gig economies have gained a prevalent role in our life and the way we work – many are unaware of how these industries affect the global economy. In this blog post, we are going to explore the impacts of these two industries and how borderless improves their payment processes.

Freelancer Marketplaces

What is a Freelancer Marketplace?

A freelancer marketplace is an online platform where service providers hire freelancers mostly for remote jobs. These marketplaces provide a safe and convenient way for service providers to hire freelancers for temporary roles. For example, if I needed to hire a freelance photographer, I could visit the marketplace online and get connected with a range of professional photographers. In general, freelancer marketplaces use a B2B or B2C model. A B2B model is where one business sells services directly to another business. In contrast, a B2C model is when a business sells services to an individual consumer. Both cases rely on e-commerce to conduct business

Payment Challenges for Freelancer Marketplaces

At borderless, we primarily serve B2B and B2C with third-party marketplaces. Our system is designed to optimize payment between businesses and payouts to sellers. Currently, the freelancer marketplace industry uses many inefficient payment processors. PayPal, for example, charges high fees and has long processing times. SWIFT bank transfers are costly and have high bank fees attached to them. borderless works to eliminate these issues with a rapid and low cost API payouts system. We make it possible to hire freelancers all over the world with some of the best prices in global payments.

How borderless works

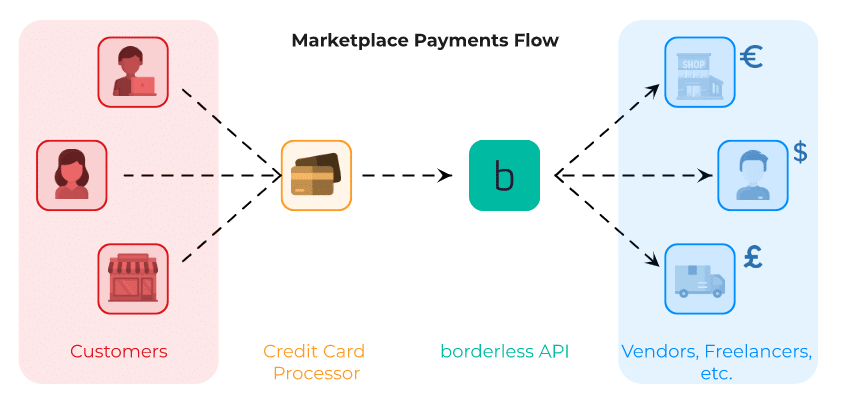

The following example will demonstrate how borderless works for an online marketplace.

- Firstly, a customer or business representative would visit the marketplace and purchase a service from a freelancer. When they pay, their card will be processed using a credit card collections platform.

- Once the card is charged, the funds are placed in the business’s merchant account held by the credit card processor.

- The marketplace transfers the funds to the borderless balance. There the marketplace can hold funds in their balance as Escrow. At borderless, we allow integration with thousands of credit card collection services such as Stripe, Square, Adyen and more so that your payments can be easily managed. Read more about this integration here.

- Now that the job is complete and the funds have reached the marketplace, you need to pay out the freelancer. Payout time! That’s where borderless shines and save you money. borderless handles global payouts with maximum efficiency so you can save time and money. You can then issue a payment to the freelancer where funds will be deposited straight to their bank account (minus the marketplace fees).

Our simple platform allows worldwide compliance, payouts to 120+ countries, white labeling, and more. Additionally, using borderless, you’ll never have to collect sensitive banking information using @handles and emails, limiting your data liability.

To read even more about borderless for freelancer marketplaces, visit our page.

Gig Economy

What is a gig economy?

Even if you have never heard the term ‘gig economy’, you’ve definitely encountered some real-life examples. A gig economy is a labor market characterized by the prevalence of short-term contacts or freelance work as opposed to full-time positions. They allow flexibility for workers as they typically have the ability to set their own hours. Some examples of gig economy positions are delivery drivers or tutors. In both cases, workers can get hired through an online platform that has access to a whole network of gig workers. These online platforms usually connect individual consumers directly to gig works so they can temporarily use the provided service.

Payment challenges for gig economies

Gig economy platforms collect payments from consumers and later distribute them to their workers. They do this in a variety of ways, however, many platforms currently use expensive and slow payment processors. This not only affects the profits of the freelancer platforms, but also gig workers as they get a smaller overall percentage of their income and get paid 1-3 days late. At borderless, we strive to optimize these payments against other payment solutions so businesses and workers can thrive.

How borderless works

Below is an example of how borderless works to improve payments for a gig economy.

- Say I’m traveling abroad to the UK and need to hire a driver for a one-time trip. I can use one of the many online ride sharing platforms to find a driver, in this case the gig worker. I then pay the online platform for the ride using a card that is set in my home currency USD. When I pay, the card will be processed using a collections platform.

- After the payment is received in USD, the ride sharing app needs to payout the gig worker. They transfer the funds to borderless in USD minus their marketplace fee (15-30%) to complete the payout. borderless allows you to easily payout workers with some of the lowest fees in the industry and using close to mid-market rates.

- Paying with borderless is fast, easy and comes at a low cost. borderless auto-converts the funds to GBP and sends the funds to the driver’s bank using local rails (ex: BACS) or Real-Time Payment rails (ex: Faster Payments) and deliver the funds instantly to the driver’s bank.

To learn even more about payments as an gig-economy platform, click here.

The Bottom Line

borderless is the payment solution that saves both time and money for freelancer marketplaces and gig economies. We offer ideal and flexible pricing, security with real-time payment tracking, and efficiency using our API platform. To learn more, schedule a demo, contact our team, or create an account today! Lastly, make sure to check back for the next installment where we will discuss the launch of our new Partner API!