5 MINUTE READ

PayPal is one of the most recognized payment processors in the payment industry, but it’s also infamous for its high fees. Learn about quick and easy methods you can use to avoid PayPal fees for your business.

Nobody Likes PayPal Fees

We know, no business likes to pay high fees for every payment they receive.

But you may be paying higher fees than you realize because of PayPal’s hidden and additional fees.

For international payments, PayPal charges 4.4% + 30 cents per transaction with an additional 3% in currency conversion fees and 1.5% in international transaction fees. That amounts to a total fee of 8.9% per international transaction.

Those are some insanely high fees!

Good news, you’ve come to the right place to find out how you can save on PayPal fees.

(To learn more about how we compare to PayPal and its fees, check out our blog on borderless™ vs. PayPal here!)

4 Ways to Avoid or Cut PayPal Fees

1. Apply for PayPal Micropayments fees

For transactions less than $10 USD, your business may be eligible to receive discounted fees.

PayPal’s micropayments pricing can be very useful, especially for businesses that receive large volumes of small transactions.

The reason is that PayPal charges a fee for every payment that businesses receive, so the more payments businesses receive, the more fees they would have to pay.

For domestic payments, you would pay 5% + $0.05 USD per transaction with micropayments pricing versus the standard fee of 2.9% + $0.30 USD per transaction.

For international payments, you would pay a fee of 6.5% + $0.05 USD versus the standard fee of 4.4% + $0.30 USD.

Confused about how you would be saving money if 5% is greater than 2.9%? The key is not the percentage, but the fixed fee of 5 cents versus 30 cents.

For example, if you receive $5 domestically, you would be paying only 30 cents with micropayments fee. With the standard fee, you would be paying 48 cents.

Although 18 cents per transaction may not seem like a lot in terms of savings, it can make a huge impact to your revenue over time, especially for businesses that receive a large number of small transactions.

2. Withdraw money from your PayPal account strategically

PayPal charges different fees depending on how you withdraw funds from your PayPal account.

For instant transfers to your bank account, PayPal charges 1% of the amount being transferred, with a maximum fee of $10. In addition, requesting a paper check costs you $1.50 per check.

To avoid such transfer fees, make sure to opt in for standard transfer.

Standard transfer, like instant transfer, transfers funds from your PayPal account directly into your bank account using direct debit transfer.

Although standard transfer takes 1 business day for domestic transfers and 3-5 business days for international transfers, it is free to use!

3. Ask to be paid in your currency

If your business receives different currencies, PayPal charges currency conversion fees when you withdraw those funds into your home currency.

Currency conversion fees can pile up pretty quickly, especially for businesses that frequently receive payments around the world.

By asking your client to pay in your home currency, you can avoid paying currency conversion fees.

4. Use Alternative Payment Processors

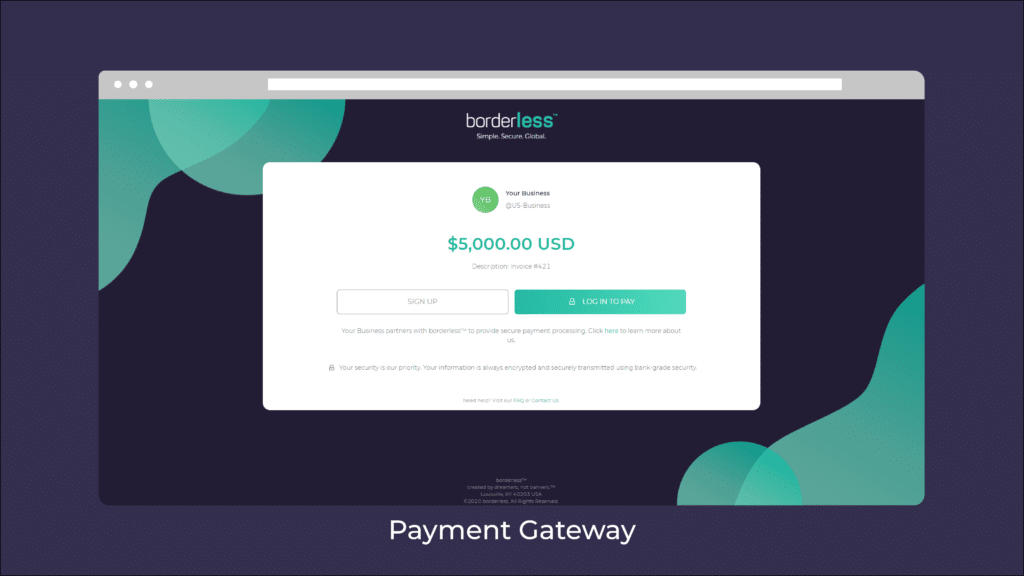

There are multiple alternatives to PayPal, but the most affordable and hassle-free option is borderless™.

borderless™ offers many of the same services PayPal offers, including

- Make and receive payments domestically and internationally

- Secure, fast, and simple payment process

- Online and in-person payment collecting methods for businesses

- Accounts for both businesses and individuals

but with lower fees.

You can send and receive money domestically and internationally more affordably than PayPal. Here’s how you can save:

1. Lower pricing for international transactions, with no separate currency conversion fees

- PayPal charges 4.4% + 30 cents per transaction with an additional 3% in currency conversion fees and 1.5% in international transaction fees.

- In comparison, borderless™ charges only 2% + 30 cents per transaction. Plus, currency conversion is included and fees are capped at $30 USD.

2. Lower pricing for domestic transactions

- For C2B payments, PayPal charges 2.9% + 30 cents per transaction, but borderless™ only charges 1% + 30 cents. Refer to our latest pricing here.

3. Tiered pricing for domestic B2B transactions

- Like C2B transactions, PayPal charges 2.9% + 30 cents per B2B payment.

- borderless™, on the other hand, offers low tiered pricing with rates of 0.1% with a max fee of $15 USD.

4. No hidden or additional fees, such as uncaptured authorization fees and card verification fees

5. No setup fees, monthly fees, or billing fees!

Plus, we do not hold your funds, which means not having to worry about paying fees to withdraw funds from your account (because there is no intermediary account).

Try calculating how much you would save by switching to borderless™ using our Savings Calculator!

Overall, switching to borderless™ is the most effective and sustainable way for you to cut down on processing fees.

Rather than making the payments process a hassle for you and your clients, we reduce your burden so that you can focus on what matters for you!

Create your borderless™ account today and start saving on payment processing fees using code GETSTARTED21, or contact a member of our team to experience a demo or if you have any questions!