4 MINUTE READ

Cash flow is an important aspect of the finances of any company, no matter the size. Improving cash flow allows businesses to operate more flexibly and have the potential for growth and development. So how can your business improve your cash flow?

What is cash flow, and why is it important for your business?

Cash flow is the net flow of money into and out of a company.

If a company has a positive cash flow, that means it is receiving more cash inflows than outflows. If a company has a negative cash flow, that means it is sending out more money than it is taking in.

Maintaining a positive cash flow is vital for a business to be able to continue operating and grow. So how can a business owner properly manage and improve their company’s cash flow?

4 Ways to Improve Your Business’ Cash Flow

1. Negotiating longer payout of contracts and expense planning

When it comes to supplier contracts, payments schedule is often overlooked yet crucial to a business’ cash flow. For example, you can negotiate a longer payout contract with your supplier so that you have more time to make the payment.

For example, if your current contract allows your company 30 days to pay a certain bill, it could be beneficial to you to negotiate a contract that gives you 60 days to finish the payment. This would allow you to have more time and flexibility, improving your cash flow.

Now, lengthening the payout time frame of a contract is only beneficial cash flow-wise to the company that is making the payment. For a company that is receiving a payment, decreasing the time that the payer company is allotted to make the payment is better for cash flow.

A tip to achieve this goal is to make the proposition mutually beneficial. Think of what you would be able to do with longer payment terms like increasing your sales which generates more revenue, thus committing to higher supply, etc). By framing the negotiation in a way that makes sense for both sides, you are more likely to come to an agreement.

Overall, it is important for both parties to come to a mutually agreeable party that is workable for the cash flow of both companies.

As far as expense planning, companies similarly should plan ahead of time for expenses they are sure about so that they can be ready to make these payments when the times come. Usually, setting out calendar reminders 3-5 days before for recurring bills helps a ton.

Being prepared for payments about which you are already aware prepares you for those about which you are not aware. If you can afford it, save about 1 month of expenses in your savings to plan for the unexpected.

2. Enforcing payment discipline

Enforcing payment discipline is all about making sure you are paid regularly and on time, without failed or fraudulent payments.

There are many questions you can ask yourself, as a business owner, in order to evaluate your current payment discipline.

How long is it taking you to get paid? Are you experiencing any disputes? How are you handling these issues as they come up? Are you wasting valuable time with reconciliation trying to hunt down payments to ensure you get paid?

A key aspect of enforcing payment discipline is setting a schedule and keeping an open line of communication between you and your customers, other businesses, or whoever is paying you.

One simple way to do so is to plan out one day per week to send out automated or manual reminders of open invoices. This way, your business is more organized and on top of outstanding payments.

A common strategy to enforce payment discipline is offering incentives for early payments and/or penalties for late payments. Such a system encourages the payer to pay you regularly and on time, or even better, early.

Payment discipline is important because it allows your company to have a reliable schedule for receiving payments. If your business model can manage it, consolidate all your incoming cash in a certain time frame of the month and consolidate bills right after that time period. This way you know immediately all your bills are paid and how much you are leftover for the month – no surprises!

With the proper system in place, you will be able to accurately predict cash inflows and be able to maintain your overall cash flow accordingly.

3. Receiving payments more quickly and more reliably with direct debit

The method by which you receive payments is another key factor in determining your business’ cash flow, and direct deposit is an efficient and growing method of receiving payments. Some methods will give you faster accessibility to your cash than others.

Although credit cards are the most common payment method for business to collect, the average payout time ranges from one to four days. You also may be able to negotiate with your credit card processor on reducing that time frame.

Direct debit is a transaction in which a business or an individual withdraws funds directly from the bank account of another person/business. In the US, direct debit transfers are executed through the ACH network. For more information about direct debit and how it works, check out our blog post on direct debit.

The key takeaway is that, compared to other payment methods like credit cards ACH direct debit is much faster and deposits the funds directly into your bank account. No holding wallets keeping your cash in your bank account where it belongs.

Moreover, disputed payments, which can arise as a result of fraudulent or failed payments, are much less common with direct debit compared to credit cards, since credit cards have a higher failure rate.

There are many options for your company to switch to or add a direct debit payment method, including borderless™.

4. Reducing costs & fees with lean operations

Though we have so far mostly discussed ways to improve cash inflows, the reality is that without proper cash outflow management, you are not going to have good overall cash flow.

There are many operational costs associated with running a business. If you are a small business owner, you might find yourself drowning in small fees and costs that quickly add up and become a significant expense for your business.

As opposed to cutting large costs, lean operations emphasize small yet recurring cost reductions that over time add up to be a high cost reduction. Cutting down on fees and costs in small but significant ways is a key point in reducing cash outflows.

Increase labor productivity by offering incentives to employees. Be less wasteful and more frugal with product inputs and figure out how to do what you do for less money.

Overall, these actions will add up and allow your company to save money responsibly and without having to engage in large-scale cuts that could be detrimental to your goals.

The Ultimate Tool to Help Improve Your Cash Flow: borderless™

By now, you might be wishing there was a way to combine all these tips in one tool that allows you to improve your cash flow.

borderless™ is the only US-based international and local direct debit solution, an online bank payment processor that allows your business to accept and make payments efficiently.

Fast Facts: How borderless Improves Cash Flow

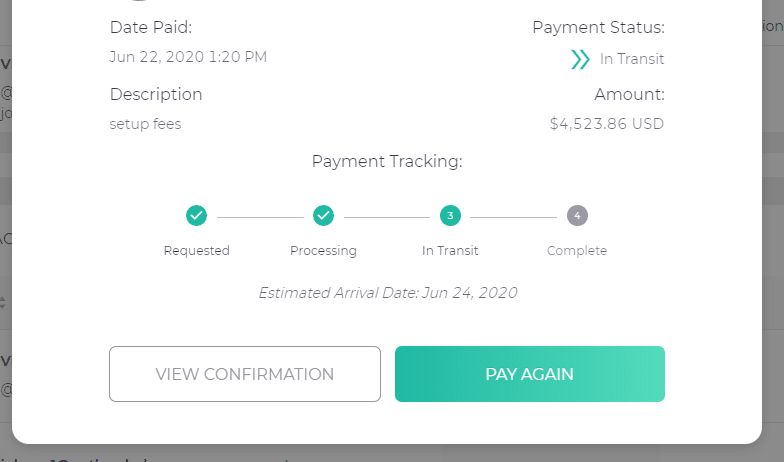

- Better expense planning with payment tracking & estimated funds arrival date

- Never chase down anyone again reducing admin time with payment reminder feature, intuitive dashboard and Search feature.

- Fast payout in just 2-3 days with direct debit transfer

- Lean operations with pay-as-you-go pricing starting with 1% rates & no setup, monthly, or hidden fees

- Capped fees for high value payments

borderless™ enables you to reduce operational fees that typically accompany payments by offering affordable rates starting at just 1% with capped fees and no setup, monthly, or hidden fees. With their Pay-As-You-Go pricing, you pay when you get paid – now that’s a payment processor for lean operations.

With our real-time Payment Tracking feature, you can track your payments like a package. It gives you the peace of mind and total visibility you need for your payments. Spend less time managing payments and more time on growing your business.

Specifically, you no longer need to waste time chasing down unpaid invoices and with our reminder feature you keep your relationship with your clients professional. Our payment tracking also comes with an estimated arrival time so you can better plan out expenses and cash flow.

Last but not least, we offer a fast payout. As a direct debit platform, there are no holding wallets that act as intermediaries, slowing down the process. Instead, you have access to your funds in just 2-3 days, which is better for your cash flow than credit cards, which have a payout of up to 4 days from the time the transaction occurs to when the funds are deposited in your bank account.

If you want to improve your business’ cash flow, sign up for borderless™ and experience our simple, secure, and global payment system for yourself today.