In the intricate world of financial services, certain terms and concepts can often seem bewildering. One such term is the “FBO account” or “For Benefit Of account.” This blog post will demystify what an FBO account is, how it functions, and why it’s important, particularly for businesses dealing with funds on behalf of their clients.

What is an FBO Account?

An FBO account, short for “For Benefit Of” account, is a type of account where funds are held for the benefit of a third party. The primary account holder is not the ultimate beneficiary of the funds. Instead, these funds are held in trust for another individual or entity. FBO accounts are commonly used in scenarios where a company or institution needs to manage and disburse funds for its clients or members.

Key Features of an FBO Account

- Trust Structure: The primary feature of an FBO account is its trust-like structure. The account is opened by one entity (often a business or financial institution) for the benefit of another party.

- Transparency and Segregation: Funds in an FBO account are clearly segregated from the account holder’s other assets. This segregation ensures that the funds are only used for the intended beneficiaries.

- Regulatory Compliance: FBO accounts often help in complying with regulatory requirements, particularly in industries like fintech and insurance, where client funds must be carefully managed and protected.

How Does an FBO Account Work?

- Account Setup: Your company open an FBO account with a bank or financial institution or through borderless. The account title typically includes the phrase “For Benefit Of” followed by the beneficiary’s name, which is your company name.

- Fund Management: Your company deposits funds into the FBO account through wire instructions, and then the amounts are allocated. This allocation is meticulously tracked to ensure accuracy.

- Disbursement: When the time comes to disburse the funds, your company makes payments from the FBO account to its beneficiaries. This process ensures that the funds are used solely for the intended purpose.

Why Use an FBO Account?

- Client Trust: By using an FBO account, businesses can demonstrate to their clients that their funds are being handled with the utmost care and transparency. This trust is particularly important in industries like fintech, where handling customer funds correctly is crucial.

- Regulatory Compliance: FBO accounts help businesses comply with regulatory requirements, ensuring that client funds are segregated and protected. This is essential for maintaining licenses and operating within legal frameworks.

- Operational Efficiency: Managing funds through an FBO account can streamline operations, reducing the complexity of handling multiple client accounts and ensuring accurate fund allocation.

Real-World Applications of FBO Accounts

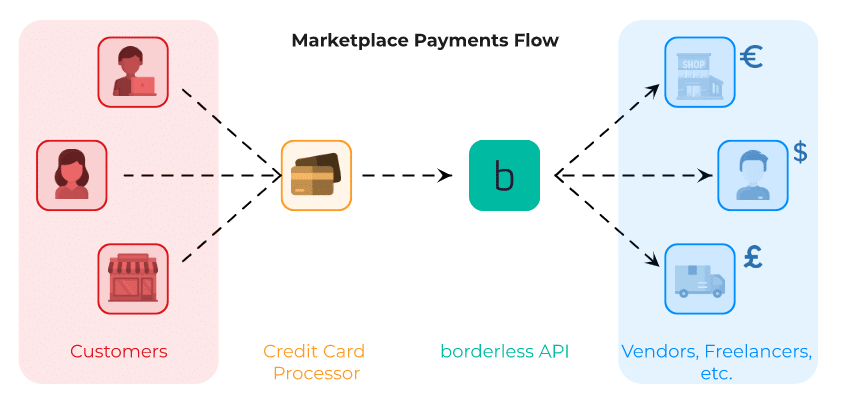

- Fintech Companies: Many fintech companies use FBO accounts to manage customer funds. For instance, borderless and its financial partners hold funds in an FBO account on behalf of its users before transferring them to the appropriate parties.

- Insurance Providers: Insurance companies often use FBO accounts to manage premium payments and claims, ensuring that client funds are available when needed.

- Online Marketplaces: In e-commerce and online marketplaces two sided marketplace platforms use FBO accounts to hold funds until the item has shipped or services rendered, ensuring that the buyer’s and seller’s interests are protected.

- Escrow Services: In real estate transactions, escrow companies use FBO accounts to hold funds until all conditions of the sale are met, ensuring that the buyer’s and seller’s interests are protected.

Conclusion

FBO accounts are a crucial tool in the financial industry, providing a secure and transparent way to manage funds on behalf of clients. By understanding what an FBO account is and how it works, businesses can ensure they are handling client funds responsibly, maintaining trust, and complying with regulatory requirements.

About Us

borderless, a global payments company that provides a payout software and API to companies to process payments to 120+ countries. borderless specializes in payouts utilizing local payment rails, real-time payment rails, and SWIFT to facilitate faster and more efficient payments. We invite you to explore how borderless can assist your business or digital platform in navigating local and international payouts. To learn more, contact our team to schedule a demo today.

#GlobalAccounts #FBO #ForBenefitOf #Cross-border #PaymentProcessing #Innovation #getborderless #Finance #Technology #Multicurrency #payouts #marketplace