Are you struggling to manage multiple payment channels and vendors? Do you find yourself spending more time reconciling payments and dealing with payment errors than you would like?

As the world becomes increasingly digital, the need for efficient and secure payment solutions has never been greater. Payment hubs and payout solutions are two technologies that have emerged as key players in this space, offering businesses a streamlined and flexible approach to managing payments. In this blog post, we’ll explore what payment hubs and payout solutions are, why they’re important, and how Borderless can help act as an industry expert in this area.

What is a Payment Hub?

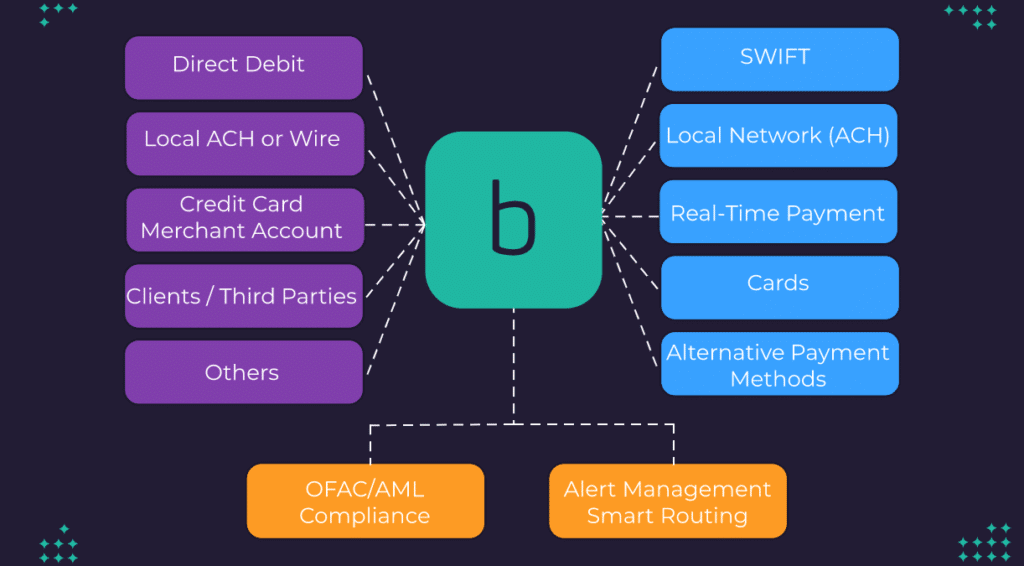

A payment hub is a centralized platform that enables businesses to manage all their payment processing activities in one place. It acts as a single point of entry for incoming payments and a single point of exit for outgoing payments, making it easier for businesses to manage and reconcile their payment flows. Payment hubs are designed to work with a range of payment rails and infrastructures, including credit and debit cards, ACH, wire transfers, and more.

Who Might Need a Payment Hub and Why?

Businesses that make frequent payments to customers, suppliers, or partners can benefit from a payment hub and payout solution. This includes businesses in industries such as marketplaces, e-commerce, travel, and gig economy platforms. These businesses face a common challenge: the need to manage multiple payment channels, each with its own set of requirements and payment rails. This often leads to inefficiencies, increased payment errors, and higher costs.

The Challenges of Managing Multiple Payment Channels

One of the main challenges of managing multiple payment channels is the complexity of payment reconciliation. Businesses need to keep track of payments across multiple channels, which can be time-consuming and error-prone. This can lead to delayed payments, unhappy customers, and ultimately, damage to the business’s reputation.

Another challenge is the lack of visibility and control over payments. Without a centralized payment management system, businesses may not have access to real-time payment data, making it difficult to reconcile payments and track payment status.

Benefits of Payment Hubs and Payout Solutions

A payment hub and payout solution can help businesses overcome these challenges by providing a centralized payment management system. This system can streamline payment reconciliation, provide real-time payment data, and improve payment accuracy. Here are some of the key benefits of payment hubs and payout solutions:

- Improved Payment Accuracy: Payment hubs and payout solutions can reduce payment errors by automating payment reconciliation and ensuring that payments are made to the correct recipient.

- Real-Time Payment Data: Payment hubs provide real-time payment data, allowing businesses to track payment status, identify payment errors, and reconcile payments across multiple channels.

- Cost Savings: By streamlining payment management, payment hubs and payout solutions can reduce the time and resources required to manage payments, resulting in cost savings.

- Flexibility: Payment hubs and payout solutions can integrate with multiple payment rails and payment infrastructures, giving businesses the flexibility to use the payment channels that best meet their needs.

Examples of Payment Rails and Payment Infrastructures

Payment hubs and payout solutions can support a variety of payment rails and payment infrastructures, including bank transfers, credit card payments, digital wallets, and more. This flexibility allows businesses to use the payment channels that best meet their needs. Here are a few example of payment rails:

- Local Payment Rails such as ACH or BECS

- Traditional Rails such as SWIFT network known as bank wires

- Cards such as Debit or Credit Cards from VISA or MasterCard

- Real-Time Payments such as Faster Payments in the United Kingdom or FedNow

- Alternative Payment Methods (APM) such as wallet systems like PayPal, Venmo, Alipay, MPesa etc.

For example, a business may choose to use bank transfers for high-value payments, while using APM payments for lower-value payments.

How Borderless Can Help

borderless offers a range of payment processing services, including global accounts, compliance as a service, a payout API and integrations to payment gateways. By partnering with Borderless, businesses can access the payment management solutions they need to streamline their payment processes and improve payment accuracy.

In addition, our team of payment experts can help businesses choose the right payment rails and infrastructures for their needs and customize a payment hub solution that fits their business model. As an industry expert in payment processing, borderless can help businesses navigate the complex landscape of payment hubs and payout solutions. borderless has experience working with businesses, marketplaces and Payment Service Providers (PSPs) in a variety of industries, and can provide insights and recommendations based on industry-specific payment requirements. With Borderless, businesses can be confident that their payments are being managed securely and efficiently.

Conclusion

Managing multiple payment channels can be a daunting task for businesses, leading to increased payment errors and costs. A payment hub and payout solution can help businesses overcome these challenges by providing a centralized payment management system, improving payment accuracy, and providing real-time payment data. borderless can act as a payout hub and an industry expert to provide businesses, marketplaces and enterprises with the payment management solutions they need to streamline their payment processes and improve payment accuracy.

About borderless

borderless, a global payments company that provides a payout software and API to companies to process payments to 120+ countries. borderless specializes in cross-border payments, and their platform utilizes local payment rails, real-time payment rails, and SWIFT to facilitate faster and more efficient payments. To learn more, contact our team to schedule a demo today.