5 MINUTE READ

Business-to-business (B2B) payments may seem very different from P2P payments facilitated by services like Venmo. But, while there are significant differences between the two types of payments, B2B payments can be just as simple and affordable as P2P.

Business-to-Business (B2B) Payments vs. Peer-to-Peer (P2P) Payments

Business-to-business (B2B) payments* occur between businesses, often for the supply side of the market. Businesses conduct transactions with many other businesses in order to acquire the input products that are needed to create the final product that they sell to consumers.

On the other hand, peer-to-peer (P2P) payments are those that occur between individuals. Common P2P payment service providers are Venmo (owned by PayPal), Zelle, and CashApp. This kind of payment can happen for countless reasons: splitting an Uber or a dinner bill, as a gift, for a private purchase, etc.

*Our blog post on the B2B E-Commerce market describes more in detail about how the B2B market works online–check it out to learn more!

The Problems with B2B Payments

P2P payments are commonly viewed as more straightforward and easy to understand and execute than B2B payments.

The average B2B transaction size for a solution like borderless™ is much larger than the average P2P transaction on apps like Venmo, as displayed in the graph below.

Moreover, there are many accessible options and apps for P2P payment services, while there is a lack of innovation or easy solutions for B2B. This is largely because there are a number of problems that complicate the B2B market:

Expensive and Present Risks

B2B payments are often quite expensive. Many B2B businesses use credit cards or wire transfers for their payments. Credit cards are notorious for high processing fees, which can hurt businesses’ bottom lines, and wire transfer fees can quickly add up as well, especially for international transactions.

Accepting B2B payments via credit cards also comes with high failure rates, which is disruptive for cash flow.

Slow and Untraceable

B2B payments are also slow and untraceable, and this is a problem for companies who already have issues with payment processing time. Credit cards and wire transfers can take days to transfer, especially for international transactions in which there are many intermediary banks and middlemen.

33% of mid-size businesses report payment processing time as a major issue, which comes from both delays in payment from suppliers and slow processing methods.

In addition to the slow transfer speed, common B2B payment methods are also untraceable, leaving your business in the dark about where exactly your money is.

Manual Process and Hidden Costs

Executing B2B payments is often a manual process that requires a lot of hands-on work for your finance team. These manual processes include issuing invoices, reminding clients to pay, and reconciling late or disputed payments.

All of these complications hinders growth and disrupts cash flow, which is a significant problem for all businesses, especially startups.

There are also a number of hidden costs that arise with common B2B payment methods. For example, PayPal and Stripe both charge many hidden fees that quickly add up and hurt your bottom line. Check out our blog posts on borderless™ vs. PayPal and borderless™ vs. Stripe for more specific information!

The B2B Market Opportunity

B2B vs. P2P – How Big Is The B2B market?

The global B2B market is 54x larger than the global P2P market, valued at $38 trillion. That’s $38,000,000,000,000, which is equal to the cost of 17.6 trillion gallons of gas, 54 million new iPhone 11’s, or 152 million Ferraris.

Although Venmo might be more recognizable to the average consumer, business owners would do well to consider the massive market opportunity that B2B entails.

B2B E-Commerce Market Size

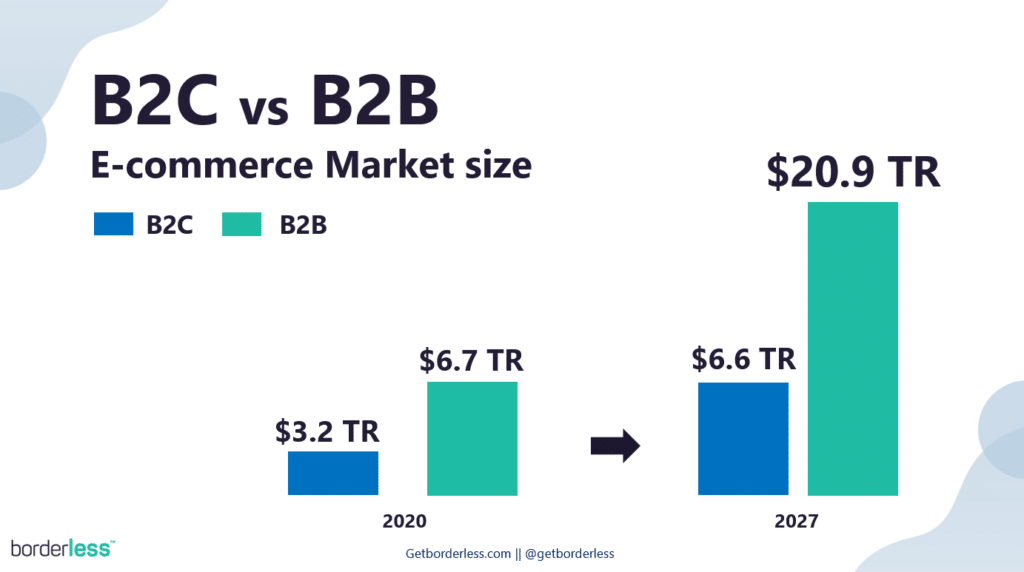

The B2B e-commerce market size is growing fast. Valued at $6.7 trillion in 2020, the B2B e-commerce market size is expected to triple by 2027 to $20.9 trillion.

As you can see in the graph, this vastly overshadows the global B2C e-commerce market size, again demonstrating the potential for businesses to grow and thrive in the B2B industry.

borderless™ and B2B Payments

B2B Payments Made as Simple as P2P Payments

borderless™ makes B2B payments as simple as P2P payments! There’s no reason why businesses should have a harder time paying other businesses in today’s technology-driven world. The following characteristics of borderless™ exemplify why we are the ultimate B2B solution.

Simple

Payments with borderless™ are simple and intuitive. Each business receives a unique @handle like on social media, as well as a PayMe™ page that can be integrated into their website, sent as a link, or even connected to a scannable QR code.

Our searchable dashboard keeps all your payments in one place and allows for easy reconciliation and management of your payment process.

Private

With borderless™, you never share your sensitive or private information, keeping it safe and secure. Our bank-grade encryption ensures that your money is in good hands, and we do not hold your money in an intermediary account; it goes straight to your bank!

Cost-Effective

borderless™ offers low, tiered pricing for local B2B transactions, and capped fees for international B2B transactions. Check out our Pricing page for more information!

Secure

Our bank-grade encryption ensures that your money is in good hands. We do not hold your money in an intermediary account; it goes straight to your bank!

Trackable

With borderless™, you can track your payments like a package, giving you peace of mind and allowing you to always know where your funds are.

How borderless™ B2B Quick Pay Works in 3 Easy Steps

The following three steps explain how borderless™ works. Yes, it’s really that simple!

1. Enter Handle or Email

Make or request a payment using email addresses or @handles. You never have to share your sensitive banking information.

2. Enter Payment Details

Enter the amount and description for your payment. Choose to pay immediately or schedule a payment for a future date. You can also add a message for a personal touch.

3. Track

After the payment is made, both parties (the payor and the recipient) can track payments in real time, giving everyone transparency over the payment process. You will receive the following payment confirmation with the tracking feature included!

Simple International B2B Payments

Now if you thought local payments are tedious, international payments are 10x more challenging. With swift routing numbers, additional personal information and correspondent banks as middlemen. We make it simple.

There are many advantages to making B2B payments with borderless™ compared to international wire transfers and other forms of payment:

No Wire Fees

International wire fees are a burden to businesses’ bottom lines. The average cost of an outgoing international wire fee is $43 and $15 for incoming international wire fees. With borderless™, making payments is always free, and we offer low rates with capped fees for international B2B payments.

Great FX Rates

Compared to other forms of payment, borderless™ has much better foreign exchange (FX) rates, allowing you to keep more of your hard-earned money. Instead of physically moving money across borders, our global direct debit system allows for faster and more affordable international payments. On average we are able to give you 2% more than most banks or PayPal.

Automated International Payments

The ability to automate international payments is important for recurring international payments like subscriptions. However, international wire transfers cannot be automated because they are “push payments” that require the payor to initiate the transfer of money for each payment.

However, with borderless™ international direct debit solution, which is a “pull payment” method, automated international payments are not only possible but also simple and affordable, reducing needless admin time for your B2B business and improving efficiency.

No Need for Foreign Bank Accounts

There is no need for foreign bank accounts when using borderless™. Your business can go global and let your customers pay like a local! Just sign in with your bank account and leave the rest to us.

borderless™ E-Commerce Plugin

At borderless™, we know that B2B e-commerce is a growing part of the B2B industry, and we offer several features to help your B2B business thrive in the online market.

Easy Integration

borderless™ offers both code and no code payment gateways. Payment requests, which can be executed through the borderless™ dashboard, require no code.

Connecting your PayMe™ page is another option for integration with your sales process. You can email the link to clients, include the link to the PayMe™ page on your website, and even provide a scannable QR code that brings clients to the page.

Lastly, you can integrate our direct debit gateway with your website with just a few lines of code. This will enable you to more effectively capture customers in the e-commerce market by having a stronger website.

Global Payouts

borderless™ also provides your business with the ability to make global payouts via our direct bank payment solution. Clients can make global bank to bank payouts in a simple click without wire fees, hassle, hidden fees and with more favorable exchange rates than most banks or PayPal.

This feature enables you to make payments in countries around the world, reaching 60+ countries in 2021.