4 MINUTE READ

A direct debit (known as ACH debit or bank debit) is an authorized payment instruction to your bank where funds can be debited from your bank account.

borderless™ is the only US-based local and international direct debit solution. But what is “direct debit” in the first place and what is used for?

What is direct debit?

Direct debit is a transaction in which a business or an individual withdraws funds directly from the bank account of another person/business. It is the simplest, safest and most efficient payment method to make regular or recurring payments

With a direct debit, you can authorize someone to collect payments from your account when they are due – for example, your utility bill, an invoice or your Spotify monthly subscription.

This process involves two parties, the recipient (who receives a payment) and the payer (who makes the payment). The payer gives the recipient permission to take money from the payer’s account whenever a payment is due. The funds are then taken (or debited) from the payor’s bank account and transferred to the recipient’s bank account.

How does it work?

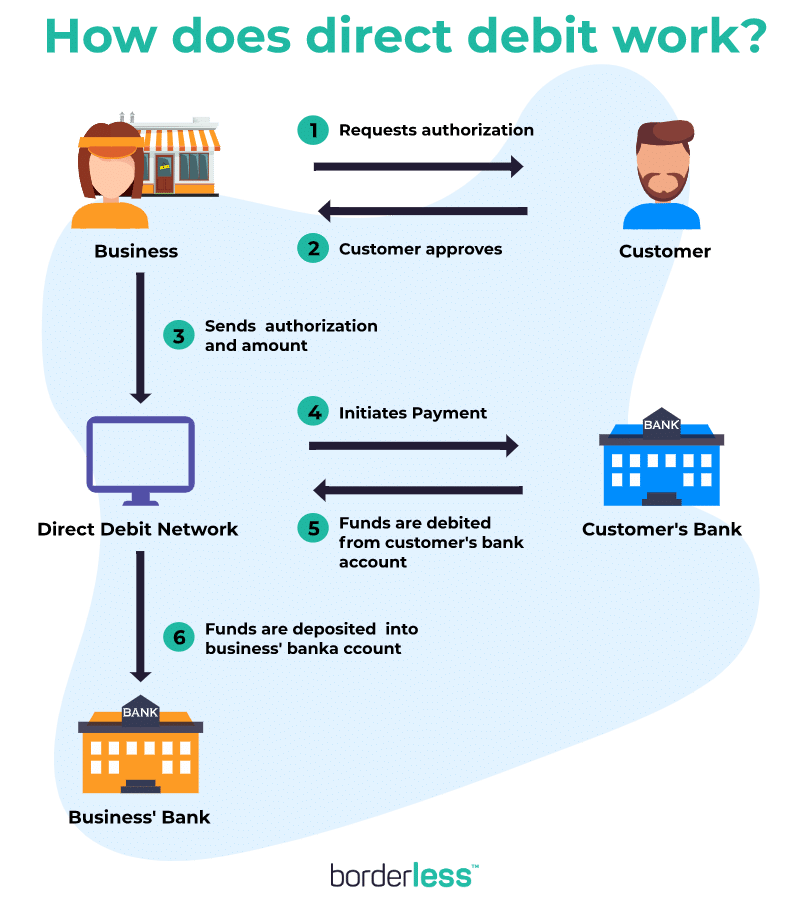

This diagram depicts the basic process for ACH direct debit transfers.

The recipient instructs their bank to collect funds from the payer’s bank account. The word debit essentially just means collect (fun fact: the word comes from the Latin word for debt, debitum, because when someone’s bank account is debited, it is recorded as indebtedness to the recipient’s bank account).

The payer must authorize the recipient to initiate a direct debit, and the funds are electronically transferred. The direct debit process works differently in different countries, but in the US, this transfer process is executed through the Automated Clearing House (ACH).

What is ACH?

Direct debit payments in the United States are processed through the Automated Clearing House (ACH) network, comprising over ten thousand financial institutions.

ACH is a computer-based electronic network for processing electronic fund transfers. This network is designed to handle large batches (millions!) of relatively low-value transactions.

ACH works on a “net balance system”: the network creates a balance sheet of how much money banks owe to other banks, and at the end of the day, the balances are paid out. This way, there are fewer transactions and faster processing speeds instead of the banks transferring money back and forth millions of times all day.

What is direct debit used for?

Direct debit is commonly used for various types of transactions:

- Recurring payments with fluctuating amounts based on usage, like utilities or phone bills.

- Subscriptions/memberships. Think of Spotify Premium /Apple Music or a membership to a local gym: you provide your bank information to the merchant and authorize them to collect a set payment amount on a weekly, monthly, or yearly basis.

- One time payments. One-time business-to-business (B2B), person-to-person (P2P) and consumer-to-business (C2B) payments. Think of an invoice, charitable giving, tuition, etc.

- E-commerce. Although direct debit does not have instant transfer of funds, borderless™ has developed a system to enable direct debit for e-commerce transactions (B2B and C2B e-commerce), saving online businesses thousands of dollars a year – See how much you can save.

Considerations for Direct Debit:

Although there are many uses for direct debit, there are limitations for this payment method:

- For businesses, setting up a direct debit payment system can be a time-consuming process to set up, and it may require a lot of time or capital to be effective. For consumers, direct debit is possible to settle bill payments through their bank, which is not an easy process.

- The settlement and payouts for direct debit payments are different compared to card payments. Card payments are settled in a day or two but are usually collected to a merchant account where the funds are held for an additional 2-10 days. Direct debit payments take between three to five days, depending on the country, but the funds are settled directly in your bank account.

- Direct debit also is limited in its global reach. There is no global direct debit payments network. Rather, each country (or region) has its own local payments clearing body: the US has ACH, the EU has SEPA, etc.

Read how borderless™ has improved upon the limitations of direct debit below.

Comparing direct debit with other payment methods

Direct Debit vs. Standing Order (aka Recurring Bill Payment)

A recurring bill payment (or “standing order” in the UK) is similar to direct debit, but the main distinction is who controls the process. Recurring bill payments are arranged by the payer, while direct debits are specified and collected by the recipient.

In addition, for recurring bill payment, the payments have a fixed amount. For example, the payer instructs their bank to make a fixed payment on a regular interval, like rent or mortgage payments. On the other hand, while direct debit can be used for recurring payments of fixed amounts, it can also be used for regular payments of variable or changing amounts, i.e usage-based services like utilities or a phone bill.

Direct Debit vs. Wire Transfer

Wire transfer is another method of transferring funds electronically across a network of banks or transfer agencies around the world.

When a person/business wants to initiate a wire transfer, they must go through a lengthy process of instructing their bank to execute a wire. The sending bank then transmits a secure message to inform the receiving bank of the payment. The receiving bank will then credit the recipient the funds in their bank account. Although it also done through a network of banks, direct debit and wire transfers are fundamentally two different systems that have several key differences:

- Transfer Speeds: With domestic wire transfer, the recipient usually receives the funds within 1 business day while international wire transfers can take up to two weeks! Direct debit transfers, on the other hand, take 2-3 business days to complete. (Note: There are steps being taken to increase the speed of direct debit payments in order to allow the same-day processing of any ACH payment.)

- Certainty/Safety: Direct debit is safer than wire transfers. With wire transfer, there are high risks with sending money: once you make a wire transfer, the process is not reversible, and since the recipient can withdraw the funds immediately, it is risky. Conversely, direct debit is known to be more secure as transfers can be reversed if there is a fraudulent transaction.

- Fees: Wire transfers are much more expensive than direct debits. For domestic wire transfers, the fee to send a wire is between $10 and $35, and some banks/credit unions also charge a fee between $10 and $20 to receive a wire transfer. In contrast, direct debit transfers are generally free for the payer, but there is usually a small fee for B2B and C2B transactions on the recipient. Some direct debit payment platforms may also charge setup and/or monthly subscription fees.

- International Reach: Though wire transfers are possible internationally, they are quite expensive. The average cost of sending an international wire transfer is $43, and the average cost of receiving one is $18. On the other hand, direct debit is limited as there is no single global ACH system. Note: borderless has made international direct debit possible and is now a very efficient method for international payments.

Now that are a direct debit expert, where does borderless™ fit in?

Direct debit + borderless™ = Global Reach and simple UX

Direct debit is one of the most efficient payment methods for individuals and businesses. However, there are two main limitations: accessibility/ease of use and global payments reach. borderless™ has solved the top two limitations of direct debit, making it the first US-based local and international direct debit solution.

borderless has spent years linking distributed local payment systems around the world under ONE global ACH system allowing for international payments. In addition, our team has developed a product that makes it easy for anyone to make and accept direct debit payments in seconds.

- User experience. We have created a seamless payment experience with one-time easy setup, simple and secure bank connection and @handle for quick user identification.

- International reach. With the borderless™ global network, international direct debit (ACH payments) is now a possibility. Cross-border payments have found a new home with no international wire fees and better foreign exchange rates than most banks or PayPal.

- Tracking. With the borderless™ payment tracking feature, direct debit can now be used for B2B and C2B e-commerce, giving our users the transparency and visibility they need for peace of mind.

- E-commerce. With the borderless™ gateway and e-commerce button, paying with your bank online has never been easier. Users can enjoy fast and secure checkout with one-click payments while businesses can benefit from alternative payment methods and increase conversion. See borderless vs Stripe

At borderless™, we empower people to follow opportunity anywhere it takes them, giving them the possibility and tools to achieve their dreams.

borderless™ is designed to offer secure payments, with low rates and fast payouts. Our API and dashboard can provide multiple ways for you to collect and send money locally and internationally saving you up to 67% in processing fees versus cards. With borderless™ you only pay when you get paid. There are no hidden, no setup, or monthly fees, and unlike wire transfers, making a payment is free and easy!

Sign up today or contact our sales team to learn more and book a demo.